How DNO&B turns pickup time data into smarter marketing

17 November 2025 | Customer data; Ticket sales; Strategy

17 November 2025 | Customer data; Ticket sales; Strategy

With pickup time, you get the answer to how early or late your audience buys their tickets before an event. In other words, it’s the number of days between the ticket purchase and the event itself. But what should you actually do with your pickup time data? And how can you make the most of the numbers?

Read the interview below with Martin Hovland, Marketing Analyst at The Norwegian National Opera & Ballet (DNO&B) and MarketHype user, as he shares how Norway’s leading performing arts institution uses pickup time data in practice.

About The Norwegian National Opera & Ballet:

The Norwegian National Opera & Ballet is Norway’s largest music and performing arts institution, dedicated to presenting opera, ballet, and concerts of the highest artistic quality. DNO&B includes the companies the Norwegian National Ballet, the Norwegian National Opera, the Norwegian National Opera Orchestra, the Norwegian National Opera Chorus, the Norwegian National Opera Children’s Chorus, and the Norwegian National Ballet School.

Martin Hovland is Marketing Analyst at DNO&B.

In the interview below, Martin explains how DNO&B analyzes pickup time, why it’s valuable, and how the insights help them create smarter marketing strategies.

– At the Norwegian National Opera & Ballet, we initially started looking at pickup time a few years ago as an aggregated number per quarter, but that didn’t give us much in-depth insight. After we started using MarketHype, we changed how we approach this by digging deeper into the data.

– We analyze how pickup time varies between different genres and productions, as well as across customer age segments and genders. We also report on the share of tickets sold within specific time windows – for example, the percentage of tickets purchased during the last four weeks before a performance.

– We constantly look for differences and then try to understand them. Are tickets for one genre generally bought much closer to the event date than for another? For instance, we’ve seen that commercial concerts tend to have longer pickup times among our younger audiences, while opera shows the opposite pattern: older attendees buy earlier, and younger ones buy closer to the performance.

– We want to understand our audience and fill our venues as early as possible. By analyzing pickup time, our marketing becomes more targeted, and we can use our resources more effectively. Maintaining an active focus on pickup time and our audience’s key buying windows gives us valuable feedback on how well our strategies are working – and allows us to adjust them when needed.

– Pickup time has changed how we allocate our marketing budget. For example, we now concentrate our marketing efforts around the periods when most people buy their tickets, and we’ve adjusted the length of our campaigns. In the future, we’ll likely use even more insights from pickup time to further refine our marketing and communication strategies.

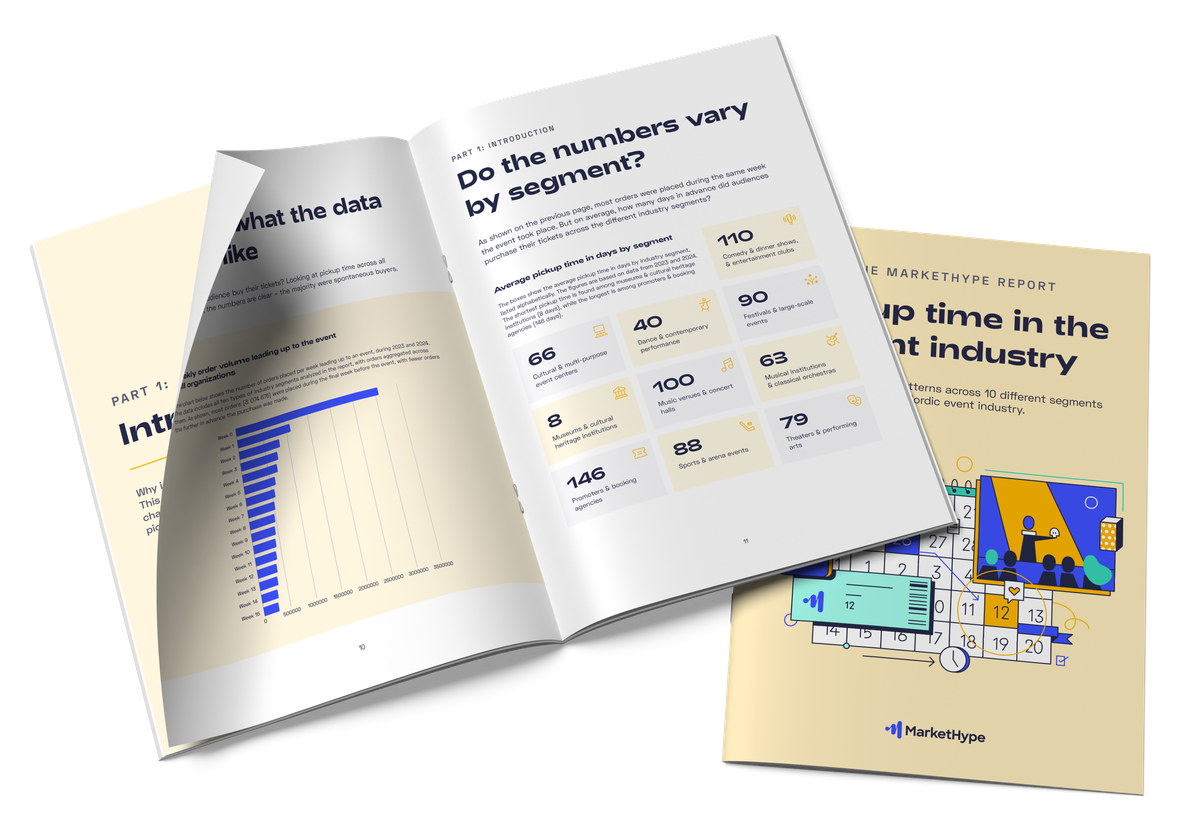

Want more tips, interviews, and data insights about pickup time? Download The MarketHype Report: Pickup time in the event industry – completely free.